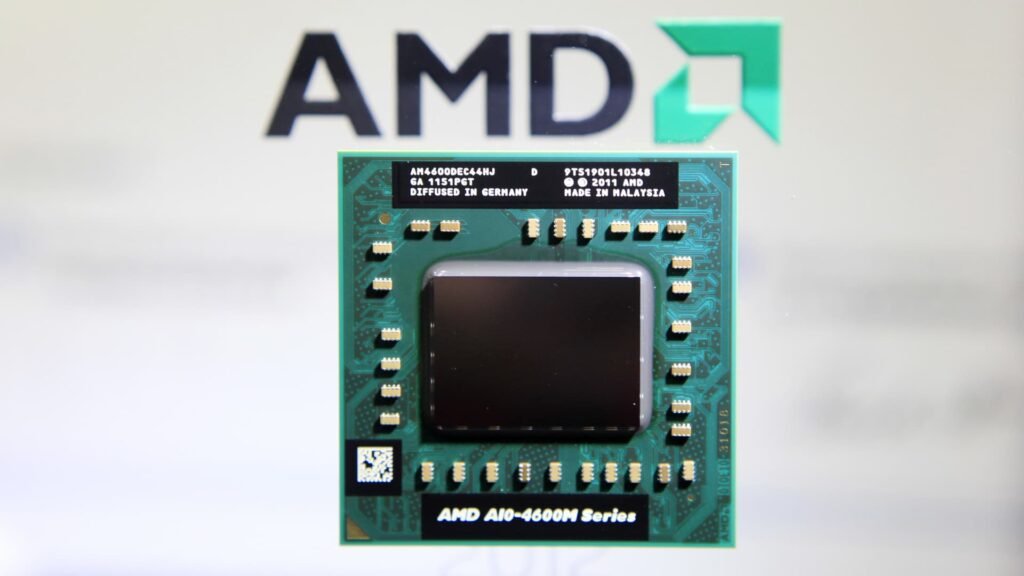

A look at companies catching our eye in midday trading: Advanced Micro Devices — The chipmaker’s shares rose more than 2%. Advanced Micro Devices announced plans to acquire server maker ZT Systems in a $4.9 billion cash and stock deal. HP — Shares fell more than 3% after Morgan Stanley cut its rating on the personal computing company to equal weight from overweight, citing limited upside potential. Sweetgreen — The salad chain fell 6% after Piper Sandler cut Sweetgreen’s rating to neutral from overweight, saying the stock’s risk and reward are more balanced. Analyst Brian Mullan announced the rating change in response to a softening outlook for the fast-casual sector, but said his long-term view on Sweetgreen remains positive. Estée Lauder — The beauty stock rose about 1%. Estée Lauder announced disappointing fiscal 2025 guidance. The company also announced that CEO Fabrizio Freda will step down at the end of fiscal 2025. FuboTV — Sports-focused streaming shares rose 33%. A U.S. court on Friday temporarily blocked the launch of sports streaming service Venu. FuboTV had argued in its lawsuit that the joint sports streaming service between Disney, Warner Bros. Discovery and Fox was anti-competitive. Taylor Morrison Home — Shares rose 3% after BTIG upgraded its investment rating to buy from neutral. The company said it had increased confidence in the homebuilder’s long-term goals. General Motors — Shares of the industrial giant rose slightly, less than 1%. GM said it would lay off more than 1,000 full-time employees worldwide in its software and services division after reviewing operations in the division. The layoffs include about 600 jobs at General Motors’ technology campus near Detroit. Dutch Bros. — The coffee chain’s shares fell 3% after Piper Sandler downgraded the stock to neutral from overweight. The investment firm said Dutch Bros. could be hurt by declining customer traffic at its fast-casual restaurants. Jim’s Integrated Shipping Services — Shipping shares jumped 23% after the company raised its full-year guidance for adjusted earnings before interest, taxes, depreciation and amortization. The company now expects full-year adjusted EBITDA of $2.6 billion to $3 billion, above its previous guidance of a range of $1.15 billion to $1.55 billion. Jim’s also said second-quarter sales were $1.93 billion. Shake Shack — The burger chain’s shares fell 3% after Piper Sandler downgraded the stock to neutral from overweight. The company cited weakening industry conditions. McDonald’s — The burger giant rose 3% after Evercore ISI raised its price target to $320 from $300. “Given improving relative market share trends recently, we are increasingly bullish on McDonald’s U.S. business in 2024 and expect this trend to continue through the second half of 2024,” the analysts said in a report on Monday. The firm maintained its outperform rating on McDonald’s. — CNBC’s Alex Harring, Michelle Fox, Yun Lee, Sarah Min, Hakyung Kim and Jesse Pound contributed to the report.

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

AMD, HPQ, SG, etc.

Related Posts

Add A Comment

Services

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

© 2026 Business Investopedia. All Rights Reserved.