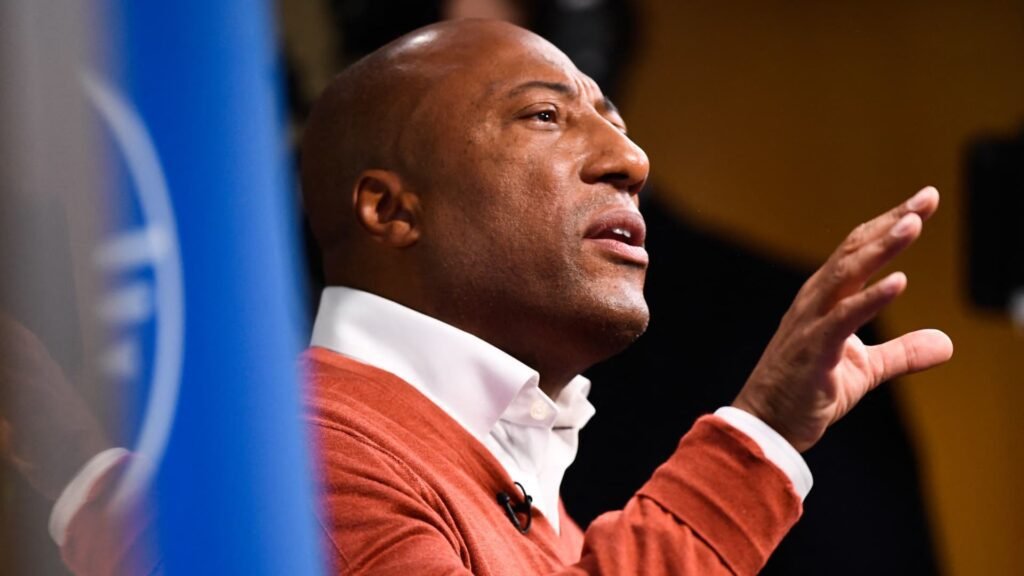

Byron Allen, founder, chairman and CEO of Entertainment Studios and Allen Media Group, speaks at the Milken Institute Global Conference on May 2, 2022 in Beverly Hills, California.

Patrick T. Fallon | AFP | Getty Images

According to a CNBC investigation, broadcast stations owned by media mogul Byron Allen, who has expressed interest in acquiring various media assets for billions of dollars, have consistently been late in making payments to network owners, angering media workers and creating distance between Allen and potential deal partners.

Allen Media Group Inc.’s stations are up to 90 days behind on payments to networks including ABC, CBS and NBC, according to people familiar with the matter. The payments total tens of millions of dollars over the course of the year, and the delinquencies have worsened over time, said the people, who asked not to be identified because the financial transactions are private.

Allen Media Group owns stations in more than 20 markets, including ABC, CBS and NBC affiliates, according to its website.

ABC, CBS and NBC all grew increasingly frustrated by what felt like an eternity of billings, even after agreeing to payment plans at Allen’s urging, the people said.Local stations pay big fees to the big network owners for their brands and some of their content, particularly live sports like the NFL and many of the interleague postseason games, but it’s unusual for payments to be consistently late, the people said.

It’s unclear why Allen Media Group has repeatedly delayed payments.

CNBC reached out to Allen Media for comment this week and the group paid the outstanding fees, according to a person familiar with the matter. The amount of the payment was not immediately available.

Cable networks often collect fees from their local affiliates every one to three months, depending on the contract. Most of the funding for those fees comes from so-called retransmission fees that cable operators pay to broadcast networks, which can mean that expenses sometimes lag behind revenue. In recent days, broadcasting group executives have argued that this structure must change as cable subscribers accelerate their churn and broadcasters move more of their content to streaming platforms.

Various divisions of Allen’s company, including stations in markets across the Midwest, Southeast, West Coast and Hawaii, have also reportedly made cuts in recent months, and one of the people familiar with the matter said he expects more cuts to come at the end of August.

A representative for Allen Media Group did not go into detail about the case but said in a statement: “Mr. Allen founded Allen Media Group 31 years ago from his dining room table. Today, Allen Media Group is one of the largest and fastest growing privately held media companies in the world and is 100 percent black-owned.”

“Like most media companies and private equity firms, we evaluate many acquisition opportunities. Over the past few years, we have successfully completed acquisitions for well over $1 billion, with the continued support of the capital markets. Allen Media Group remains strong and will continue to carefully manage our partner relationships, as we have always done throughout our 31-year history,” the statement said.

Representatives for ABC, CBS and NBC declined to comment for this story.

Allen’s Business

Mr. Allen’s tens of millions of dollars in delayed payments stand in stark contrast to his frequent multibillion-dollar bids for media assets. Investment bankers and lenders have lost confidence in him as a serious buyer of large assets after he pursued deals that didn’t come to fruition in recent years, three investment bankers and a person familiar with the matter said.

Allen’s recent M&A interests include a $30 billion bid for Paramount Global earlier this year, a $10 billion bid for ABC and other Disney networks last year and a $3.5 billion bid for Paramount’s BET Media Group (which he re-offered in December after the acquisition process closed).

There have also been recent reports that Allen is considering a new takeover bid for Paramount before a “go-shop” period with buyer Skydance ends at the end of this month.

Allen has been vocal about his ambitions to expand his media assets and has defended his track record of failed acquisitions, telling CNBC in January that recent bids had fallen through because some owners ultimately decided not to sell.

“There are a number of banks that are willing to help us and be on our side, as well as private equity firms,” Allen told CNBC in September about a potential deal for ABC and Disney’s other assets. “I think other assets will start to become available and I think we will eventually be able to acquire them.”

Allen Media Group has been republishing public media reports on its website that it is interested in bidding for media assets, including unconfirmed reports of interest, such as an $8.5 billion takeover bid for Tegna.

Allen, a former comedian, founded the entertainment studio now known as Allen Media Group in 1993. Allen Media Group Broadcasting was formed in 2019 and since then Allen has built a broadcast media empire through a series of smaller deals.

Allen Media also owns The Weather Channel and broadcast television stations, as well as a group of smaller television networks including Pets.tv and Comedy.tv, and TheGrio, a black news and entertainment network.

Then in April 2021, Allen Media paid $380 million to Gray TV Gray sold seven stations as part of a divestiture necessary to acquire Quincy Media.

Allen’s station, like most others, makes money through advertising and so-called retransmission fees – fees that broadcasters receive from pay-TV operators for broadcast rights – but station groups are feeling the pinch as millions of people switch from traditional TV to streaming.

With a record increase in political advertising expected ahead of the presidential election, some major broadcast station owners are Nexstar Media Group and Sinclair This has been documented in recent earnings calls.

Disclosure: Comcast’s NBCUniversal is the parent company of CNBC and broadcast network NBC.

Correction: Allen Media Group acquired seven stations from Gray Television for $380 million in April 2021. An earlier version of this article misstated the timing of the deal.