Atlanta-based fintech company Greenlight is working to establish more partnerships similar to those it has with U.S. Bank and Workday.

The company offers a banking app and debit card for teens and children, and currently has about 75 partners. JPMorgan ChaseThe company has “hundreds” of potential partners, though CEO and co-founder Tim Sheehan declined to disclose future partner goals.

Banks, credit unions and large corporations pay Greenlight to provide the fintech’s services to their customers and employees. The Chicago-based company Northern Trust Bank The company said this month it was partnering with Greenlight to give its customers access to Greenlight’s services. The fintech also announced a partnership with tech giant Google this month. Integrate Green Light For kids smartwatches.

The corporate side of Greenlight’s partnership efforts is the latest. HR software company WorkdayIn a recent interview, Sheehan said “several major U.S. companies” are considering adopting Green Light as an employee benefit, but he declined to name the companies or say whether the company plans to announce any new partners this year.

“When we partner with them, it’s often free for the end consumer,” Sheehan said of Greenlight’s services. Last year, the fintech said such partnerships were Greenlight’s Efforts to increase profits.SAs with other software-as-a-service pricing models,Partner-paid green light A spokesman said it was based on size, without providing details.

Sheehan declined to say whether Greenlight is profitable, saying the company is “in a stable position.” The company has raised about $556 million in venture capital and has no plans to raise new capital, Sheehan said.

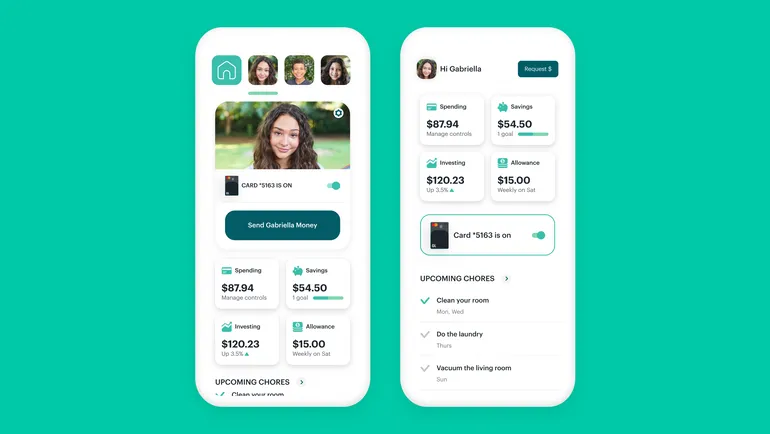

The fintech has around 6.5 million parent-child users and monthly plans range from around $6 to $15 per month.

Greenlight, which has about 400 employees, underwent a “reorganization” earlier this year, but Sheehan declined to provide details beyond saying the company was looking to become more efficient. He said the company continues to hire, particularly in sales, business development, engineering and product.

Editor’s note: This interview has been edited for clarity and brevity.

BANKING DIVE: Is Greenlight currently getting more business through these partners than selling directly to consumers?

Tim Sheehan: We don’t share the breakdown. The partnerships have grown very quickly, not just in terms of the number of partners, but also the number of consumers and families that we’re reaching through them. This is not surprising, because our direct-to-consumer business has been around for quite some time, having launched in 2017.

Tim Sheehan

Used with permission from Christy Jiang

of Underlying aspects of the partnership with US Bank This is unique compared to other partnerships Greenlight has entered into so far. Do you expect more banks to follow suit in this regard?

Yes, I think so. Because if you’re a bank or a credit union, it’s a smart way to incorporate Greenlight into your product, and you get to take advantage of Greenlight’s innovation and speed. As Greenlight innovates and adds more capabilities and features, you can quickly incorporate that into your consumer offering because you’re using our embedded software development kit. You’re going to see a lot of that happening. A lot of people will probably deploy it leveraging our embedded SDK.

Where do you see further opportunities in terms of new products and services?

The safety aspect is pretty impressive. We’ve added location sharing among family members, collision detection, and an SOS button in case kids or parents feel in danger. This button will notify family members or emergency services and they will be dispatched to the location.

We are getting closer to announcing additional safety features that are currently being tested. This area of family safety is the newest addition we’ve made.

This is interesting because it’s a bit outside of the banking and spending focus.

It’s about serving families in a way that’s really helpful. Parents want to teach their kids to be smart about personal finances and money, but they also want to keep their kids safe. For us, it seemed like a very natural thing to add because we felt like we could add real value there.

How does Greenlight aim to understand what parents and younger consumers want from banking products?

A lot of the people who work at Greenlight are parents themselves, so they have a certain insight because they empathize with the problems we solve for families. I have four kids. My co-founder, Johnson Cook, has three kids.

Honestly, we pay close attention to all the feedback we get, whether it’s app reviews, emails, phone calls, etc. And we proactively reach out to our customers and their families and ask questions and listen. What are they worried about? That’s what sparked a lot of the things we’ve done. The financial literacy game came out of conversations with our customers. Safety was something we felt we understood well because we’d spoken to a lot of our customers.

There’s been a lot said about the “co-opetition” between banks and fintechs, but what does the future of bank-fintech partnerships look like?

At the very least, Greenlight is a great example of a partnership that makes a lot of sense because it complements banks, not competes with them.

Obviously, there are fintech companies that are competing directly with banks and credit unions. A few years ago, when venture capital was more readily available, it was easy for fintech companies to raise capital and compete directly with banks. But I think a lot of fintech companies are running out of capital and are finding it harder to compete with banks.

What do you think about your competitors?

What worries me are big companies like Apple, because some of the things they do seem to give them a competitive edge over any small company.