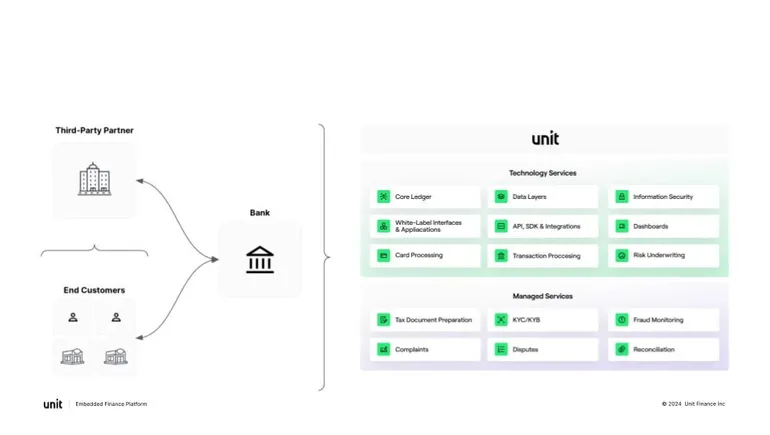

Embedded finance platform Unit Finance has invested this year to strengthen its banking oversight products to help banks respond to increased regulatory scrutiny of third-party partnerships, said CEO and founder Itai. Damty said.

The division’s monitoring suite provides banks with tools to manage compliance, reconciliation and third-party risk. It aims to provide banks with real-time data access, increased transparency, and enhanced controls to reduce risk and monitor programs.

“We are at a point where the hurdles for banks to operate in this space are rapidly increasing, and we want the unit to be well-positioned to serve these banks and expand our partner banking network,” Damty told Banking Dive. I think so,” he said.

Regulators have been monitoring bank-fintech relationships for the past two years, issuing consent orders to multiple banks, including Blue Ridge Bank, First Fed and Piermont Bank, over issues within their fintech programs. And recently, the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation jointly released third-party risk management guidance for community banks.

As regulators try to keep up with the rapidly changing world of fintech, “banks need to answer more questions as part of their exam cycles, and we are more than happy to help answer those questions.” The more we can do that, the better off the banks are in providing space,” Damty said.

Unit CEO and Founder Itai Damti

Permission by Unit Finance

The questions banks face from regulators “change seasonally,” he said. Since the start of the Russia-Ukraine war, banks have faced further questions related to IT and security. And after the failure of Silicon Valley Bank, they faced further questions about the stability of their deposits.

“By staying responsive to the needs of our banking partners and the types of questions they might have for their customers, we can build more tools to help them succeed and help them answer them. Masu. [regulator] Ask better questions. We do not believe that technology can replace risk management, but it can enhance risk management and make operations more efficient for banking partners,” Damty said.

He believes the regulatory oversight is a sign of the ecosystem’s maturation, and thinks it’s a good thing overall, even if some players in the system see it as time for an exit.

“Historically, things like this happen when ecosystems become more important. And historically, as a result of increased scrutiny, things like this have become clearer,” he said.

He said: “With clarity, companies and banks can operate with more confidence, and regulators want to keep this area going, and they don’t have to worry about what might happen in the future. “It leads to an understanding that we just want to maintain it in the best way possible, rather than just preserving it in the best possible way.” Let’s restore the ecosystem. ”

Damty said the pendulum always swings between investing in the future, such as bank monitoring investing, and seeking more immediate profitable results. Based on the company’s existing balance sheet, the unit “could ultimately be profitable without the need for additional financing,” he said.

He stopped short of providing a timeline, noting that investors may choose to make additional investments, which could delay profitability.

“When an opportunity comes along, or a series of opportunities comes along, we want to be able to make those decisions in real time and not be tied to a timeline that we decide on today,” Damty said. he said. “But we’re definitely trying to think seriously about business success, revenue growth and the company’s bottom line.”