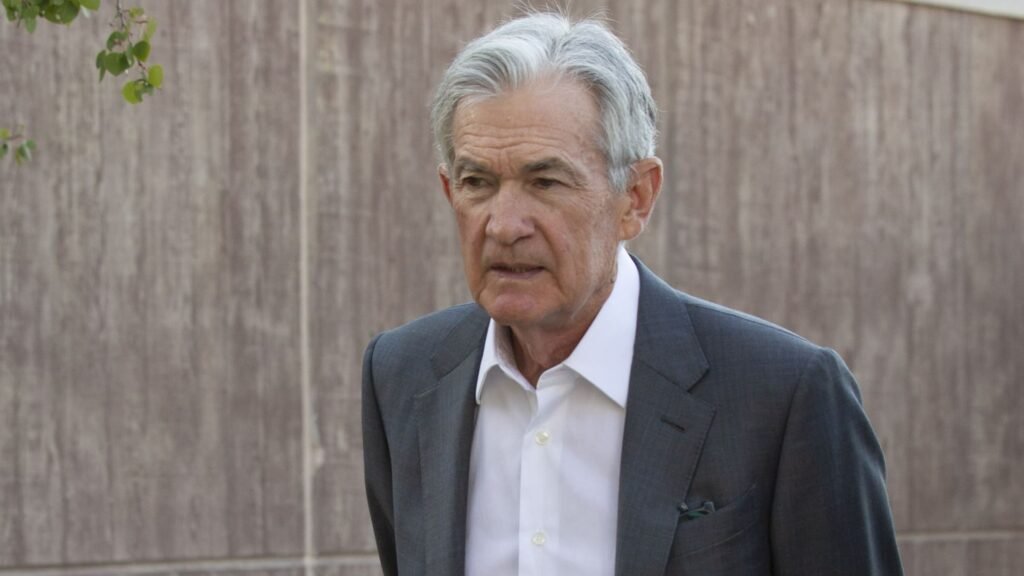

With Federal Reserve Chairman Jerome Powell effectively acknowledging that a rate cut is imminent, market attention on Friday quickly shifted to when and how much of a cut would come. Traders continue to price in the Fed’s likely long-term easing in September with a 0.25 percentage point (25 basis point) cut. But the likelihood of a more aggressive cut, such as a half-point cut, is quickly increasing to about a one-in-three chance, according to pricing in the 30-day federal funds rate futures market as measured by CME Group’s FedWatch. Market participants see this as especially likely if the August employment report, due for release on Sept. 6, is a repeat of July’s weaker-than-expected figure. The Fed’s next meeting is less than two weeks away, on Sept. 17. “My base case is that we’re probably going to see 25 basis point cuts over the next eight meetings, and several hundred basis point cuts in total,” economist Paul McCulloch told CNBC’s “Squawk on the Street.” “But if growth weakens, and employment in particular weakens, I think there’s a chance that we could start with a 50 basis point cut frontloaded.” “I don’t think that’s the base case yet, but clearly he’s opened the door to frontloading the process of easing just as he frontloaded the process of tightening,” added McCulloch, a former Pimco managing director who is now a senior fellow at Cornell University and an adjunct professor at Georgetown University. Powell’s long-awaited speech at the Fed’s annual symposium in Jackson Hole, Wyoming, clearly hinted that a rate cut was on the way. “It’s time to adjust policy,” Powell said. Rationale for a half-point cut However, he was less direct about the timing and pace of the rate cut, leaving markets to guess how much of a cut Powell is prepared to make. But some of the chairman’s remarks seem to indicate a bias toward quicker action, especially if the employment situation continues to worsen. “We do not seek or welcome a further cooling in labor market conditions,” Powell said. This, along with other pledges to support the economy now that inflation has weakened, suggests that at least a 50 basis point rate hike is on the table. The Fed’s base rate, which influences most of the other interest rates paid by consumers, is currently targeted at a range of 5.25% to 5.5%. Markets expect the central bank to make a one-percentage-point cut this year and at least in 2025. “It seems to me that going to 50% gives the Fed more options,” said Joseph Lavorgna, chief economist at SMBC Nikko Securities. “If we were planning for what we thought would be 25-25-25 in September, November, December, why not make it 50% from the start? We know we have to lower rates. If things get better, that’s fine. Why wait?” Jobs data is key In separate interviews with CNBC on Friday, Fed Presidents Raphael Bostic in Atlanta and Austan Goolsby in Chicago suggested a rate cut was coming but did not commit to a specific easing strategy. “The numbers are starting to move in the direction that shows policy is working and we can start to put us on a path to lower rates.” [return] “We need to get our policy stance back on track,” Bostic said, “and we can’t wait until inflation hits 2%. Inflation has come down substantially, so this is something we have to think about seriously.” Now, attention is turning to the August employment report, due in two weeks. The July employment report showed employment increased by just 114,000 jobs and the unemployment rate rose to 4.3%, but if the numbers are weak again, the Fed is likely to approve a half-point rate hike. Conversely, any signs that the labor market has strengthened would not prevent the Fed from cutting rates, but a quarter-point hike would be almost certain. Rick Rieder, chief investment officer of BlackRock’s global fixed income team, said in a client note that Powell’s comments that “the direction is clear” suggest a rate cut and that “there is room to cut rates by 50 basis points to get closer to levels that are still restrictive relative to current economic and inflationary conditions.” “We believe the Fed should lower rates to the 4% federal funds rate sooner to be more in line with current economic and inflation conditions,” he said. “We are in a position where we need to raise rates by 50 basis points over the next few meetings,” he added. “The Fed’s current thinking is that the data should allow us to do that.” Correction: Austan Goolsbee is president of the Federal Reserve Bank of Chicago. An earlier version listed his location incorrectly.

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

Markets are now worried that the Fed could cut rates by half a percentage point in September.

Related Posts

Add A Comment

Services

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

© 2026 Business Investopedia. All Rights Reserved.