Listen to the article

This audio is automatically generated, please let us know if you have any feedback.

Two Democratic senators expressed concern about recent statements by JPMorgan Chase suggesting it would impose new fees on checking accounts.

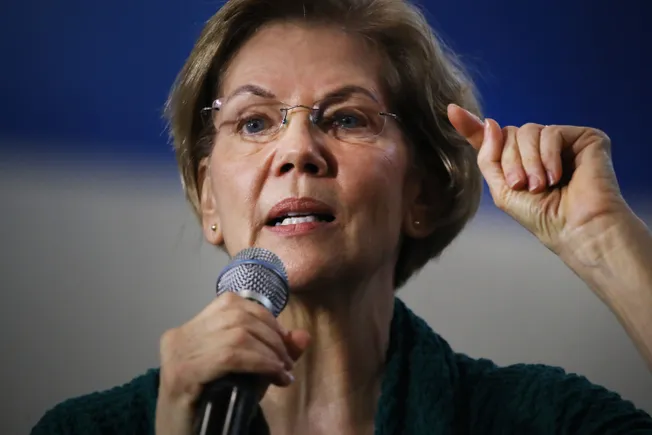

In a letter to the bank’s CEO Jamie Dimon, Sens. Elizabeth Warren, D-Mass., and Chris Van Hollen, D-Md., said the potential new costs were “exorbitant” when compared to the record $49.6 billion profit JPMorgan posted last year.

“It is outrageous that JPMorgan Chase could impose new costs on customers in response to legal and long-overdue efforts to limit unfair fees at a time when the bank is raking in record profits and funneling those profits directly into the pockets of its executives,” the senators wrote on Friday. “JPMorgan Chase should put on hold its plans to impose additional fees on working Americans.”

Marianne Lake, JPMorgan’s head of consumer and regional banking, told The Wall Street Journal last month that if the regulations become law, the bank plans to offset the rising costs of the regulations on consumers by charging fees for checking accounts and wealth management tools.

“The people who will be most affected are those who can least afford it, and they’re going to have a much harder time getting loans,” Lake told the magazine.

The senators pointed to findings from the Consumer Financial Protection Bureau that found 9% of consumers pay roughly 80% of overdraft and non-sufficient balance fees, and that 9% are often the most vulnerable.

The CFPB in January Reduce overdraft fees charged by banks with more than $10 billion in assets to a minimum of $3 and a maximum of $14. The proposed rules would require banks to classify overdraft fees as an extension of credit and subject them to the same consumer protections as credit cards. They would also require banks to disclose the annual percentage rate at which these fees are charged.

The proposed rules would allow banks to choose whether to do their own calculations or charge a threshold set by the CFPB. The proposed changes are aimed at reducing the $9 billion in annual revenue banks make from overdraft fees, the CFPB estimates. The $9 billion total is itself down from $12.6 billion in 2019.

JPMorgan collected $1.1 billion in overdraft income last year and has returned $30 billion to investors through its stock repurchase program, the senators wrote on Friday.

“There is simply no justification for imposing new fees on working families while banks generate enormous profits,” the lawmakers wrote, calling the bank an “industry leader when it comes to usury fees.”

In fact, that $1.1 billion is equal to what Bank of America and Wells Fargo raised in 2023 combined. CNBC The February report, which cited regulatory filings from all three banks, reported CNBC that the three banks took in a combined $2.2 billion in overdraft fees in 2023. That figure was down about 25% from the previous year, or $700 million.

Warren and Van Hollen argued that JPMorgan would lose 2 percent of its profits if it didn’t charge overdraft fees, and questioned whether a 2 percent loss justified imposing broad new rules on customers.

The senators asked what new fees banks plan to impose once the CFPB’s rules are finalized, and how JPMorgan plans to protect low- and moderate-income customers from the fees.

They also asked for an estimate of how much banks would collect in overdraft fees under the CFPB’s rules, and whether banks would cut stock buybacks or executive compensation in exchange for imposing the new fees. They are asked to respond by August 28.

Overdraft fees have been out of the spotlight for a while, but they’ve come back into the spotlight in 2021 and 2022 as many banks have reduced or completely eliminated overdraft fees. The largest banks to eliminate overdraft fees are Citi and Capital One, while Bank of America and Wells Fargo have significantly reduced their overdraft fees.

Meanwhile, JPMorgan gave customers an additional business day to bring their overdraft account balances back down to $50 or less before it began charging fees. At the time, JPMorgan executives said the changes were “not insignificant.”

Warren and Dimon have frequently clashed when the CEOs appear before Congress. During a 2021 hearing on overdraft fees, Warren called Dimon “a scammer.”Star of the Overdraft Show” He argued that JPMorgan was making enough profit without charging the fees.