Dive Overview:

Customers of banks affiliated with bankrupt fintech intermediary Synapse owe $85 million more than they have in their accounts with those banks, Synapse’s trustee said in a filing last week in the US Bankruptcy Court for the Central District of California..

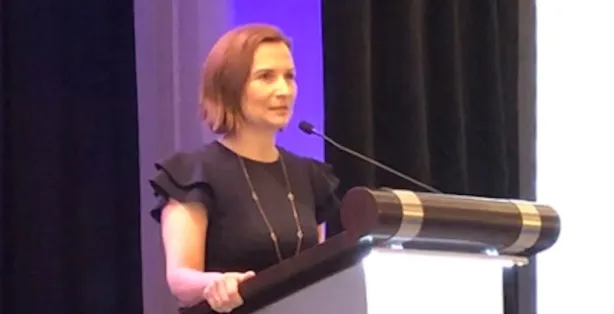

The report was released the day before a hearing in which Trustee Jelena McWilliams, a former chairwoman of the Federal Deposit Insurance Corp., proposed several options to a judge that could allow some customers to regain access to funds that have been frozen for about a month..

But during the hearing, Judge Martin Barash said it was unclear what the bankruptcy court could do because the debts are not the property of Synapse Foundation. “This is a crisis, and I’d like to see a solution, but what people are asking for … I’m not sure that’s something I can provide in terms of a court order,” Barash said, calling the case “uncharted territory,” according to CNBC.

Dive Insights:

Synapse filed for bankruptcy in late April and entered into a $9.7 million deal to acquire its assets from money transfer platform Tabapay, but Tabapay terminated the deal less than three weeks later, citing Synapse’s failure to meet closing conditions.

Since then, more than 100,000 customers have been locked out of their accounts at banks that have partnerships with Synapse due to disputes over user balances.

Synapse fired all of its employees on May 24 and appointed McWilliams, a managing partner at law firm Cravath, Swaine & Moore, as receiver. CNBC reports that McWilliams has been working with Synapse’s four banking partners — Evolve, American Bank, AMG National Trust and Lineage Bank — to help clients regain access to their frozen funds.

Banks aren’t the only ones affected by Synapse’s collapse: As of late May, around 85,000 customers of fintech company Yotta reported losing access to their accounts.

Bankruptcy also Teen fintech Copper abruptly shut down its bank account and debit card services last month..

At issue, according to McWilliams’ report, is that Synapse’s partner banks held roughly $180 million in combined current and profit-sharing accounts linked to end users, but McWilliams found that those users were owed $265 million.

“The cause of the shortfalls is currently unknown, including whether end user funds and negative balance accounts were transferred between partner banks, increasing or decreasing respective shortfalls that may have previously existed at each partner bank,” McWilliams wrote.

It’s possible that Synapse used multiple banks to commingle funds to some of the companies, but McWilliams said more information was needed, including how Synapse’s brokerage and lending practices affected the flow of funds.

But with no money to pay for an outside forensic firm and no remaining Synapse employees to call on for help, a more thorough investigation of the money trail would be difficult, McWilliams wrote.

McWilliams said some current account customers have resumed access to their funds, but added that for those whose funds are pooled in beneficiary accounts, a full reconciliation could take several weeks.

At Friday’s hearing, McWilliams recommended that Barash make partial payments to all beneficiary customers, which would “partially mitigate the impact on end users who are currently waiting for limited access to their funds,” while also preserving reserves for later payments, according to CNBC.

McWilliams did not respond to a request for comment from the network.