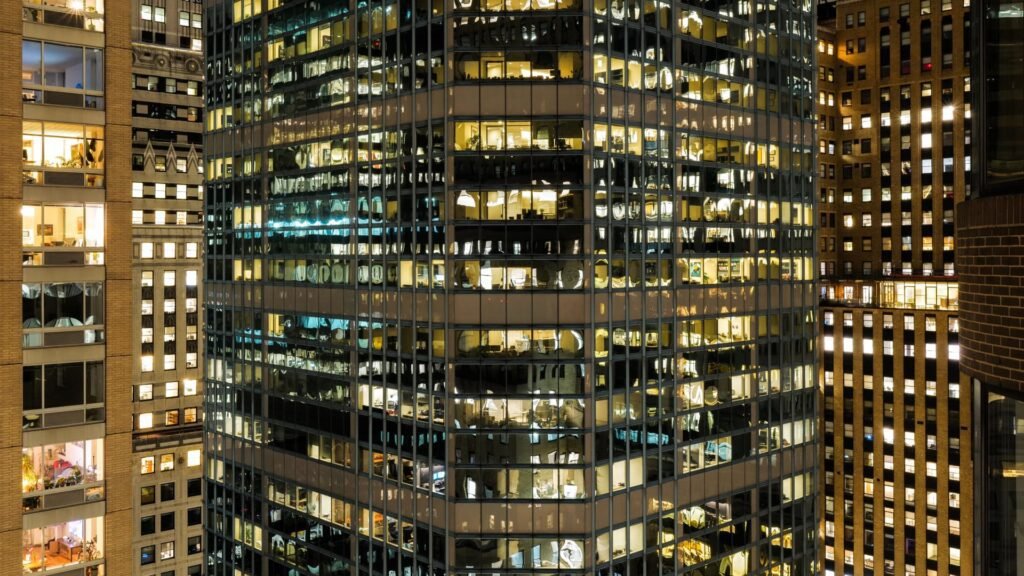

Real estate is part of the market that investors are entering amid rising expectations of interest rate cuts. The market expects inflation data this month to give the Federal Reserve justification to cut interest rates, as the Fed has repeatedly stated that lower consumer prices are necessary to cut interest rates. Real estate-related assets, such as REITs, are generally thought to benefit from low interest rates. This is because much of the investment in this asset class involves leverage and borrowing, and the lower interest rates are, the lower the cost of holding the investment. A low interest rate environment also increases the attractiveness of this investment in terms of the high rental income yields that real estate offers. However, there are no guarantees, and these real estate assets can also perform well when interest rates are high. For example, the extent of borrowing costs depends on a variety of factors, including the debt burden and industry sector. For those interested in REITs, Morningstar is bullish on them as “cheap” stocks that offer high yields. That’s U.S.-listed Kilroy Realty, Morningstar equity analyst Suryanshu Sharma said in a July report. The company owns, develops and acquires premium office, mixed-use and technology and life science industry-related properties in U.S. cities. Also in July, Morningstar’s chief U.S. market strategist Dave Sekera named Kilroy one of four new stocks to buy as a “future earnings catalyst.” “With significant exposure in its portfolio and development pipeline, the REIT is poised to benefit from the fast-growing life sciences sector,” Sharma said, adding, “While remote and hybrid work solutions will become more accepted, offices will remain central to workplace strategies.” He estimates Morningstar’s fair value for the REIT at $59, which he said represents a 46% undervaluation. Office utilization will increase over time, leading to a recovery in office real estate demand, he said. Over the next decade, Sharma expects the average rent per square foot in Kilroy’s portfolio to grow at a compound annual growth rate of 0.9%. “We believe Kilroy’s significant development pipeline will yield approximately 6.50% through 2033, providing accretion to net operating income and a significant contribution to the company’s valuation,” he said. Currently, Kilroy’s dividend yield is about 6%, according to FactSet data. “The focus on technology and life sciences market clusters should benefit Kilroy in the long run, as we expect rapid growth in these areas. The company’s quality office buildings are amenity-rich and should benefit from the flight-to-quality trend,” Sharma said. Sekera noted that while Kilroy is “the most undervalued” of the REITs surveyed by Morningstar, the company’s bias toward the technology sector is a positive. “When you look at employment in the technology sector, employment is growing,” he said. “Looking at measurements of tech job ads within certain market areas, some of the big tech companies, including Apple, Alphabet, Amazon and Meta, are asking employees to return to the office and to a hybrid work schedule of at least three days a week.” He also noted that the buildings in Kilroy’s life science portfolio are 11 years old, which is considerably newer than many of its peers. That means occupancy rates should improve, Sekera said. But Sharma said investors overall should keep in mind that the ongoing remote work trend across industries remains a major risk. “The remote work trend is perhaps the biggest source of uncertainty for the office real estate industry. The pandemic has shown us that technology can help employees collaborate and remain productive even while working remotely,” he said. “Hybrid workplace policies are now increasingly becoming the norm, posing a significant challenge for future office demand.”

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

This ‘cheap’ REIT is set to offer a yield of nearly 7%, according to Morningstar

Related Posts

Add A Comment

Services

Subscribe to Updates

Subscribe to our newsletter and stay updated with the latest news and exclusive offers.

© 2026 Business Investopedia. All Rights Reserved.