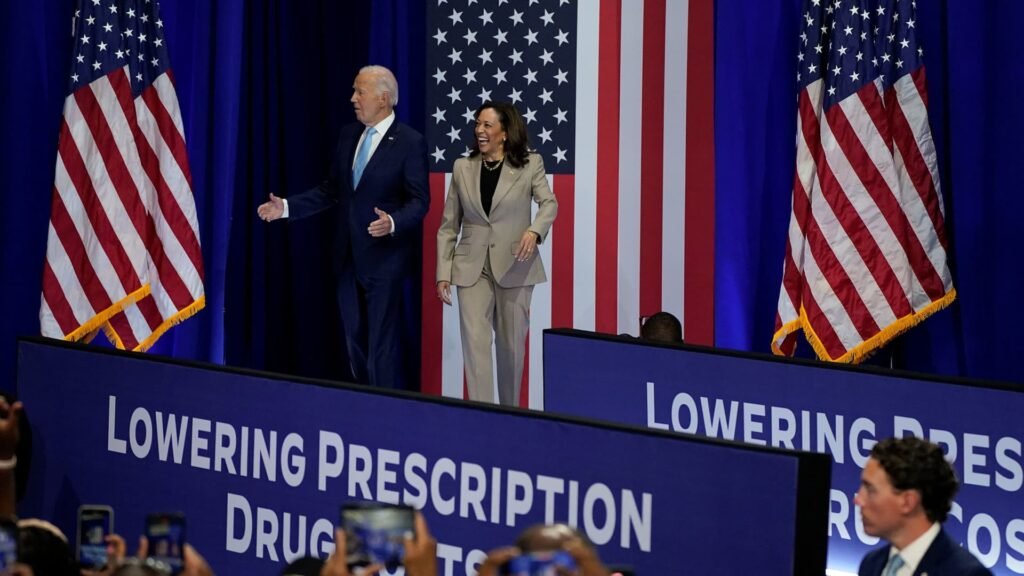

US President Joe Biden and Vice President Kamala Harris attend an event together on Medicare drug price negotiations in Prince George’s County, Maryland, USA, on August 15, 2024.

Ken Cedeno | Reuters

The Biden administration on Thursday achieved a milestone in Democrats’ decades-long effort to use Medicare to lower prescription drug costs, announcing new prices for the first 10 drugs that will be subject to negotiations between the federal program and drug companies.

But the announcement is just the beginning of a contentious, multi-part process that could save taxpayers and seniors even more money and put more pressure on drug companies in the long run. It’s a key provision of President Joe Biden’s signature Fight Inflation Act, signed into law nearly two years ago.

The agreed price will take effect in 2026 and set a precedent for future negotiations starting next year. Those talks are likely to affect prices for dozens of more widely used medicines made by the world’s largest pharmaceutical companies for years to come.

“I think people should have the expectation that this is just the beginning. These are just the first 10 drugs,” said Lee Purvis, prescription drug policy director at the AARP Public Policy Institute, an arm of an influential lobbying group that represents people over 50 and has been pushing for Medicare negotiating rights.

“Sometimes people get hung up on the fact that their medication isn’t on the list, but if they’re taking medications that cost a lot of money, it’s likely that at some point in the future they will be on the list,” Purvis added.

It is unclear how much lower the negotiated prices will be than the current net prices for the first 10 drugs that are heavily discounted in Medicare Part D plans. These net prices are not publicly available, so it is difficult to know how much Medicare plans and patients will actually save on specific drugs when the negotiated prices begin in 2026. Out-of-pocket costs may also vary depending on which Part D plan a patient has.

“That number isn’t publicly released, so it’s hard to know the starting point,” Tricia Newman, executive director of the Medicare Policy Program at health policy research institute KFF, said of the discounted net price.

Still, the Biden administration estimates that the new negotiated drug prices would generate net savings for the Medicare system of about $6 billion and reduce beneficiaries’ out-of-pocket costs by $1.5 billion in 2026 alone.

“The negotiations appear to have gone relatively smoothly, and the aggregate savings are pretty impressive,” Newman said, adding that “savings will likely increase over time” as more drug prices are finalized in upcoming negotiations.

The price negotiations could also put further pressure on drugmakers in the coming years: Many of the drugs covered in the first round of talks are already nearing patent expiration, opening the market to competition from cheaper generic versions and squeezing profits.

for example, Bristol-Myers SquibbThe company’s blood thinner Eliquis is set to lose patent exclusivity in the United States starting April 1, 2028. The blockbuster drug also goes off patent in some EU markets in 2026.

But over time, drugs that are much less likely to lose market exclusivity may be chosen in future negotiations, Leerink Partners analyst David Rising said in a research note on Thursday.

The Biden administration will select up to 15 more drugs for the next round of price negotiations by February 2025, with the new prices set to take effect in 2027. Drugmakers have until the end of February to decide whether to join the program — a no-brainer for companies that would face steep excise taxes and lose access to federal Medicare and Medicaid programs if they don’t.

“The pain will only increase over time,” Jeff Jonas, a portfolio manager at Gabelli Funds, said in a statement Thursday. For example, he noted that the next round of pricing talks will likely include: Novo NordiskOzempic, the top-selling diabetes drug.

“There is also speculation that the government may have gone easy on pharmaceutical companies this year, given that it is an election year and this is the first time the government has taken such measures,” Jonas added.

After the second round, the Centers for Medicare and Medicaid Services can negotiate prices for another 15 drugs that will take effect in 2028. That number will increase to 20 drugs per year starting in 2029.

For the first two years of negotiations, CMS will select only Medicare Part D drugs for coverage. In negotiations that take effect in 2028, it plans to add more specialty drugs that are typically doctor-administered and covered under Medicare Part B.

This could pose a bigger threat to the pharmaceutical industry, since Medicare Part B drugs are not as heavily discounted as those covered under Part D.

“My guess is that because of the limited reimbursement, they’ll be even cheaper compared to the more heavily reimbursed Part D drugs,” Rising said of drugs covered under Part B in an interview with CNBC.

Jonas noted that the 2028 price change negotiations could include several big cancer drugs, including: MerckThe blockbuster chemotherapy drug “Keytruda.”

Democratic presidential candidate Vice President Kamala Harris would seek to broaden the scope of negotiations if elected and “is likely to be more aggressive about discounting,” Jonas said.

But Newman said passing a stronger bill would depend on which party controls the House and Senate, and Harris herself had to cast a tie-breaking vote in the Democratic-controlled Senate to pass the original bill.

“Some Democrats in Congress are interested in doing that, but of course the law depends on which party is in power,” Newman said.

The pharmaceutical industry argues that the negotiations could hurt revenue, profits and innovation in the long term.

For example, Steve Uble, CEO of PhRMA, the pharmaceutical industry’s largest lobbying group, said in a statement Thursday that price negotiations would “fundamentally change” the incentives for drug development, potentially resulting in fewer treatments for cancer, mental health, rare diseases and other conditions.

Medicare can begin negotiating prices for small-molecule drugs as early as nine years after approval by the U.S. Food and Drug Administration, but it takes 13 years for biopharmaceuticals, which are made from chemicals with low molecular weights and are derived from living organisms such as animals or humans.

The industry argues that this distinction discourages companies from investing in small-molecule drugs.

—CNBC’s Angelica Peebles contributed to this report