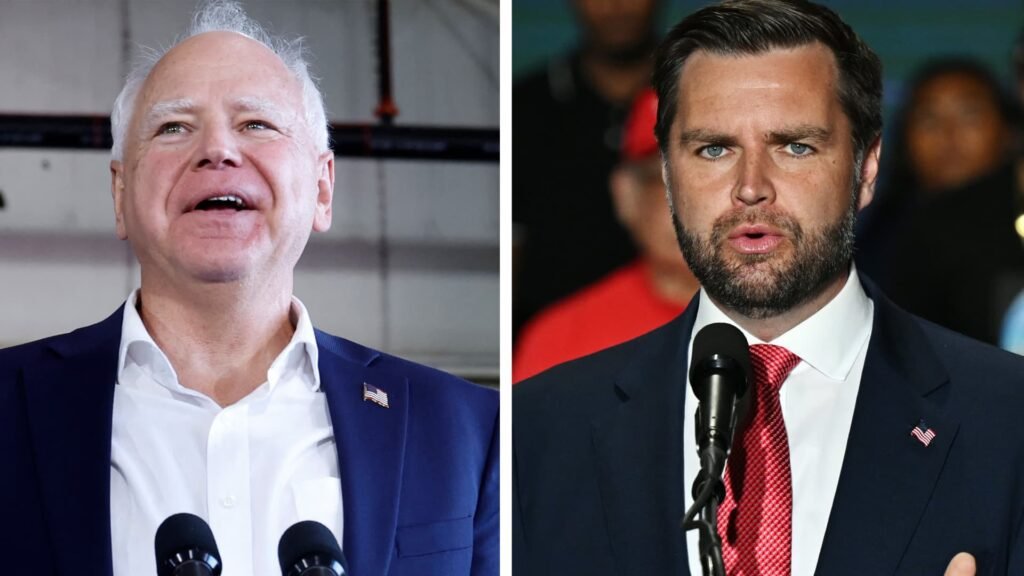

Democratic vice presidential nominee and Minnesota Governor Tim Walz (left) and Republican vice presidential nominee Senator J.D. Vance of Ohio.

Getty Images

housing

Affordable housing is a key issue for many Americans, and both Walz and Vance have been committed to the issue.

In May 2023, Governor Walz signed a housing bill that included $200 million in down payment assistance. The bill also included $200 million for housing infrastructure and $40 million for workforce housing.

“We expect Walz will advocate for a demand-driven approach to housing,” TD Cowen analyst Jarrett Seiberg said in a July statement. “This is the type of housing policy we would expect to see from a Harris administration,” she wrote.

Demand-side approaches to housing aim to help individual households by improving the quality of their housing or reducing their monthly housing costs.

Vance, a vocal advocate of affordable housing, highlighted the issue in his acceptance speech at the Republican National Convention and throughout his campaign.

“Before running for Senate, Vance argued that one of the keys to fighting poverty was tackling affordable housing,” and he has opposed institutional ownership of rental housing and Chinese buyers of U.S. real estate, Seiberg wrote.

Child Tax Credit

Without Congress’s action, trillions of dollars in tax cuts enacted by President Trump are set to expire after 2025, including the child tax credit, which will be reduced from $2,000 to $1,000 per child.

Congress approved a temporary expansion of the child tax credit in 2021 that included monthly advance payments, which helped reduce the child poverty rate to a record low of 5.2% in 2021, according to a Columbia University analysis.

Following the federal policy, Minnesota enacted a state-level refundable child tax credit in 2023, which Governor Walz called a “signature achievement.”

Minnesota’s new child tax credit is unusual in its narrow scope, but it is the most generous credit in the country for low-income families.

Jared Walczak

Vice President of State Projects at the Tax Foundation

“Minnesota’s new child tax credit is unusual in how narrow it is,” said Jared Walczak, vice president of state projects at the Tax Foundation, “but it is the most generous credit in the country for low-income families.”

But a permanent expansion of the federal child tax credit could be difficult with a divided Congress and growing concerns about the federal budget deficit.

Walz’s campaign did not respond to CNBC’s request for comment.

Senate Republicans blocked an expansion of the federal child tax credit last week, in a vote that Sen. Mike Crapo (R-Idaho), the ranking member of the Senate Finance Committee, called “a blatant attempt to score political points.”

Despite the procedural vote failing, Crapo said he was open to negotiating a “child tax credit solution that a majority of Republicans can support.”

Democrats scheduled the vote in part in response to Vance, who has positioned himself as a pro-family candidate and has voiced support for the child tax credit, though he did not attend the Senate vote.

Vance’s campaign did not respond to CNBC’s request for comment.

Student Loans

Vance has voiced his opposition to student loan forgiveness policies.

“Student loan forgiveness is a huge benefit to the rich, the college-educated, and most of all, America’s corrupt university administrators,” Vance, a Yale Law School graduate, wrote for X in April 2022. “Republicans must fight it with all their might.”

The United States has about $1.6 trillion in outstanding student loan debt. About 43 million people, or one in six adult Americans, have student loan debt. Women and people of color are the most heavily in debt.

Vance has appeared to support loan forgiveness in extreme cases: In May, he helped introduce a bill that would have forgiven student loans taken out by parents for their permanently disabled children.

Jane Fox, president of the Legal Aid Association Lawyers Union (UAW Local 2325), said Vance’s portrayal of debt forgiveness as a benefit to the wealthy is hypocritical and wrong.

“Student loan forgiveness is a working-class issue,” Fox said. “The top 1% of people who went to elite schools and then went on to work in private equity, like Senator Vance, have little need for debt forgiveness.”

Vance’s campaign did not respond to CNBC’s request for comment.

Meanwhile, Walz, a former teacher, has supported programs to ease the burden of student loan debt, said Mark Kantrowitz, a higher education expert.

Kantrowitz said Minnesota has enacted a student loan forgiveness program for nurses and a free tuition plan for low-income students.

“With our daughter preparing to start college next year, tuition fees and student loan debt are at the forefront of our minds,” Walz wrote on Facebook in 2018. “All Minnesotans deserve the opportunity to receive an excellent education without being hindered by rising costs and student loan debt.”