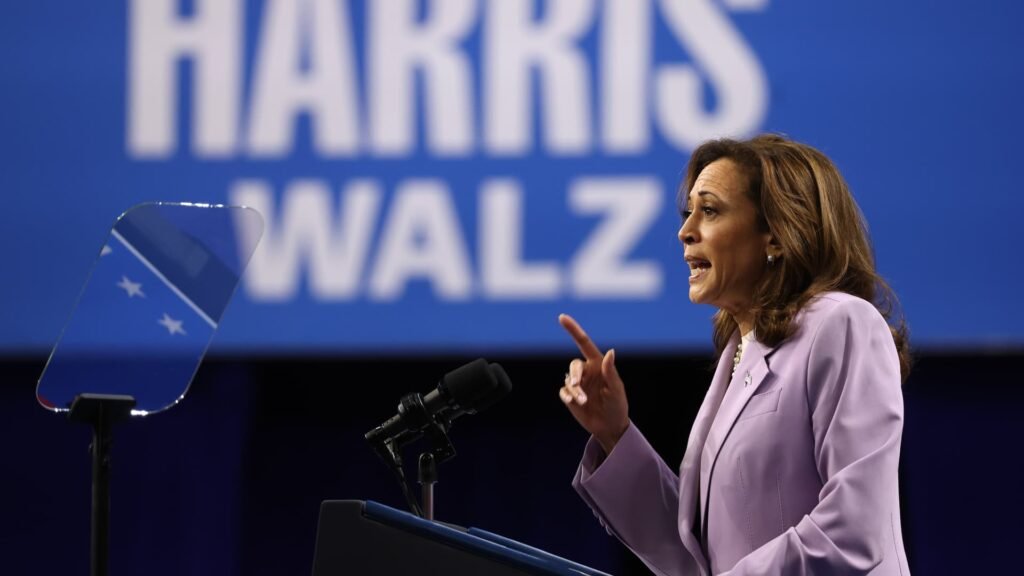

Democratic presidential candidate and Vice President Kamala Harris speaks at a campaign rally in Las Vegas on August 10.

Justin Sullivan | Getty Images News | Getty Images

Supply is the “bipartisan sweet spot” of housing policy

“The one thing we can agree on bipartisanly right now about the problem of rising housing prices is to increase supply,” said Dennis See, executive director of the J. Ronald Terwilliger Housing Policy Center at the Bipartisan Policy Center.

The number of new single-family homes and rental apartment complexes being built has fallen sharply since the foreclosure crisis of 2007-2010, when the U.S. saw a wave of foreclosures, said Janeke Ratcliff, vice director of the Housing Finance Policy Center at the Urban Institute, a nonprofit think tank in Washington, D.C.

There is an “even more acute shortage” when it comes to affordable housing, both for renters looking for quality rental property and for first-time home buyers, she said.

In an effort to reach 3 million new homes, the Harris-Walz Administration would implement a “first-of-its-kind tax incentive” for homebuilders who sell their first homes to first-time homebuyers, according to a proposal released last week.

According to the announcement, the initiative will complement the Neighborhood Housing Tax Credit, which would be created by a bill currently before Congress called the Neighborhood Housing Investment Act.

See said the tax credit “has strong bipartisan support” and will encourage the construction and renovation of starter homes for sale in distressed areas.

My conclusion is [Harris’] A housing project would be worse than doing nothing.

Edward Pinto

Senior Fellow and Co-Director of the Center for Housing at the American Enterprise Institute

Former President Donald Trump also spoke about ways to increase housing supply as part of his presidential campaign pledges.

“We’re opening up some federal lands for housing construction,” Trump said at a press conference on August 15. “We desperately need housing for people who can’t currently afford it.”

But Edward Pinto, senior fellow and co-director of the Housing Center at the American Enterprise Institute, said it would be “much harder” for the government to pass “supply-side proposals” than efforts to stimulate demand by making it easier for consumers to buy homes.

“My conclusion is [Harris’] A housing project would be worse than doing nothing,” he said.

“It’s hard to define what a starter home is.”

James Tobin, CEO of the National Association of Home Builders, said it was important for Harris to clarify what she meant by “starter home.”

“What a first home is is hard to define,” Tobin said, because underlying costs make it hard to keep construction costs low.

“In most markets around the country, it’s difficult to build homes for first-time homebuyers because of the cost of labor, land, builder borrowing costs and materials,” he said.

Tobin said it’s also important to define the price range for your first home, because it can vary widely depending on the market.

“In California, the cost of a first home is [$700,000] Or $800,000, whereas in the South it might only be $250,000 or $300,000,” he said.

$40 billion innovation fund seems ‘very expensive’

Harris’ list of proposals also includes a $40 billion innovation fund that would allow local governments to fund and support local solutions for building housing.

But some experts are skeptical that it will achieve its intended purpose.

“The federal government doesn’t have much power over what happens at the local level,” Redfin’s Fairweather said. “It’s up to local planning commissions to decide whether or not to permit housing to be built. [innovation fund] money.”

“But local residents, local councils and local homeowners are very resistant to building more housing, so time and time again incentives are ignored,” Fairweather said.

Additionally, the $40 billion Housing Innovation Fund may be too expensive and is unlikely to garner bipartisan support, Shi said.

“That price seems very high,” he said. “I’m not sure the market can bear that price in Congress.”

Less support for first-time home buyers

Harris has proposed offering $25,000 in down payment assistance to first-time homebuyers who have paid their rent on time for two years, with even more generous assistance for qualifying first-generation homebuyers.

The proposal stems from an idea unveiled by the Biden-Harris administration earlier this year, which called on Congress to provide $25,000 in down payment assistance and a $10,000 tax credit for first-time buyers targeted at 400,000 first-generation buyers — those whose parents are not homeowners.

Harris’ plan would apply to all first-time buyers and expand coverage to more than 4 million eligible applicants over four years.

But “there’s not a lot of bipartisan support,” See said.

Speaking on Fox Business on August 16, Sen. Tim Scott (R-Lausanne) said Governor Harris’ $25,000 down payment assistance “is only going to increase demand while supply remains static, which means prices will go up and fewer people will be able to buy homes.”

“Frankly, unless we build financial literacy into some programs, we’re just going to see higher levels of default,” Scott said.

Harris pointed to two pending bills to help renters. She called on Congress to pass the Stop Predatory Investment Act, a bill that would eliminate a major tax break for people who own 50 or more single-family homes, which discourages big investors from buying up large amounts of single-family rental housing.

Meanwhile, the Act on Preventing the Algorithmic Promotion of Rental Housing Cartels will crack down on companies that use algorithmic systems to fix market rent prices.